Tax Relief and Trade Protections: What Mold Builders Need to Know

New tax legislation delivers R&D deduction benefits and manufacturing facility depreciation, while expanded tariffs provide import protection amid persistent workforce challenges.

The American Mold Builders Association's year-end webinar delivered important updates that will impact mold builders' bottom lines. While the news includes tax benefits and stronger trade protections, the industry continues to face its skilled workers shortage, with hiring needs at five-year highs, and varied profitability across shops. Here's what matters most.

R&D Tax Deduction: Finally Fixed

After three painful years, mold builders can finally deduct research and development expenses in the same year they spend the money; just like they could before 2022. Even better, you can now write off all those R&D costs you had to spread out from 2022-2024 in one shot this year.

For a typical $22-23 million mold shop that accumulated $3.2 million in R&D expenses over those three years, this means an immediate, substantial tax break. Shops with annual sales under $31 million can even go back and amend their old tax returns to get refunds.

Why does this matter? Because most of what mold builders do counts as R&D. When you're designing a custom injection mold, you're solving unique problems through computer modeling, mold fill analysis, sampling and testing. All of that qualifies. On top of the deduction, you can still claim the federal R&D tax credit worth 6-9% of your qualified spending.

Big Incentives for Building and Equipment

The new tax law introduced something called Qualified Production Property (QPP) that lets you write off 100% of a new manufacturing building in the first year. This applies to production floor space and possibly quality control areas, though the IRS is still working out details about building additions and how it works if your building is owned separately from your operation.

The rules are specific: you must start construction after January 20, 2025, and finish by 2031. Combined with the return of 100% bonus depreciation on equipment purchases and the ability to immediately write off up to $2.5 million through Section 179, shops have tools to invest in new capacity.

Important timing note: if you signed a contract before January 20, 2025, your equipment won't qualify for the 100% write-off, even if it arrives later.

Stronger Protection from Foreign Competition

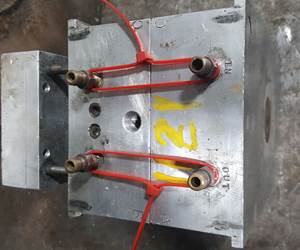

AMBA successfully pushed for 50% tariffs on several types of molds, including injection molds for plastic or rubber, blow molds and compression molds. Chinese plastic injection molds now face a total of 85% in tariffs when you add everything together.

Additional mold categories like mold bases and semiconductor molds are still being considered for protection. Meanwhile, a rule that would require licenses to do business with Chinese-owned companies got postponed until November 2026, but could still help U.S. shops if it goes into effect.

Mexico is also cracking down on Chinese products coming through their country with new inspections and tariffs, which creates more opportunities for U.S. exporters.

The Workforce Problem Isn't Going Away

Despite the good news on taxes and trade, AMBA's survey data shows the same challenges persist. Finding and keeping good people is still the number one concern. Shops are planning to hire at levels not seen in five years, but the pool of workers aged 18-50 keeps shrinking.

Profitability is all over the map, too. While some shops are doing great with profit margins above 9%, a significant chunk of the industry is struggling with margins below 4%.

The data also shows that just paying more isn't enough anymore. Workers want real opportunities to advance, companies that invest in new technology and a workplace where they feel valued and heard. Flexible schedules and professional development have become must-haves, not nice-to-haves.

What You Should Do Now

Talk to your tax advisor immediately about claiming your R&D catch-up deduction and planning equipment purchases to maximize tax benefits. If you're thinking about expanding your facility, look into whether it could qualify for the QPP treatment. Also note that energy-efficient property credits expire on June 30, 2025, so act fast if you have improvements planned.

Consider joining AMBA to access resources that can easily cover your membership costs. Members get two hours of free legal advice, two complimentary training sessions on topics like benefits and data security and access to detailed industry benchmarking data, including wage surveys and hiring best practices. Most importantly, AMBA's advocacy work directly secured those 50% tariffs on molds and continues fighting for policies that protect U.S. shops. Visit https://amba.org/ to learn more about membership and how the association is actively working to level the playing field for American mold builders.

With stronger trade protections in place and historic tax incentives available, 2025 is an exceptional time to invest strategically in U.S. mold manufacturing capacity.

Related Content

How Adler's Global Network and In-House Labs Address Complex Mold Challenges

Adler combines 0.0001" tolerances, reverse engineering capabilities, global facility coordination and comprehensive in-house validation labs for seamless mold solutions.

Read MoreWhat You Should Know About Injection Mold Safety Straps

Every mold should have one in order to be safe and OSHA compliant.

Read MoreTop 10 Topics to Cover During an ISO 9001 Manufacturing Audit

Take a look at this practical hands-on approach to conducting a quality audit.

Read MoreShift in U.S. Mold Imports: Emerging Countries Gain Ground in Market Share

The dynamic nature of the U.S. mold industry's global trade landscape offers challenges and opportunities for growth.

Read MoreRead Next

Your Guide to Smarter, Faster Mold Design

Dive into expert-curated content delivering proven solutions for mold optimization, manufacturability and precision performance.

Read MoreHow to Use Continuing Education to Remain Competitive in Moldmaking

Continued training helps moldmakers make tooling decisions and properly use the latest cutting tool to efficiently machine high-quality molds.

Read MoreOvercoming Pain Points in Moldmaking with AI

Shops that embrace AI as a tool, not a threat, can enhance efficiency, preserve expertise, and attract tech-savvy talent.

Read More