One Word: Plastics

Plastics is still king, and the latest U.S. Size and Impact Report from the Plastics Industry Association has the numbers to prove it.

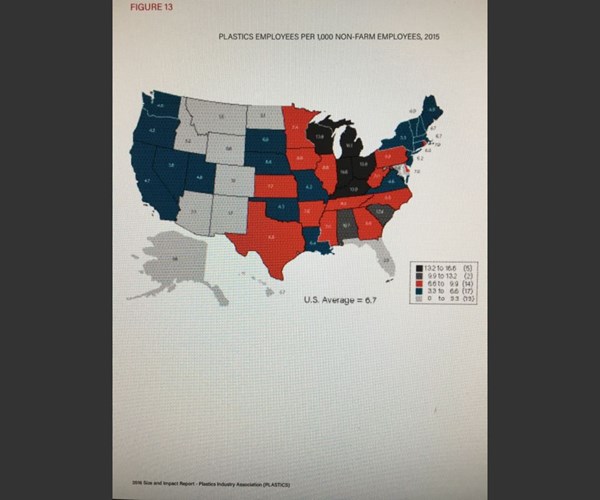

Map of the U.S., taken from the Plastics Industry Association's 2016 Size and Impact Report, shows where plastics industry employment is concentrated.

Plastics is still king, and the latest Size and Impact Report from the Plastics Industry Association (PLASTICS) has the numbers to prove it. PLASTICS recently released its 52-page report, saying that “the U.S. plastics industry remains the third-largest manufacturing sector overall, and accounts for $418.4 billion in shipments and 954,000 workers in 2015—and that the industry is ready to lead a revolution in American manufacturing.” This should be very heartening to the moldmaking industry, given that it has been determinedly pushing to lead said revolution in a way that will bring the rebirth of a robust American manufacturing-based economy. So, I say, to arms!

Some noteworthy statistics (using the most recently available data) provided within the report are as follows:

- The U.S. plastics industry accounted for a 1.4 percent increase in shipments and jobs over 2014, and that when suppliers to the industry are added, total shipments become an impressive $571.5 billion and jobs soar to 1.75 million, bringing the overall increase to nearly 3 percent.

- The plastics sector once again trumps the U.S. manufacturing sector the report says, for the 35th year, having outperformed all of U.S. manufacturing in real shipments, productivity growth, real value added, and employment. Yes, employment! Plastics added jobs at an annualized rate of 0.3 percent from 1980 to 2015 while manufacturing as a whole lost jobs at an annualized rate of -1.2 percent, according to PLASTICS’ report.

- More specifically, a table within the report breaks the plastics industry down by sector, and says that the “molds for plastics” manufacturing sector grew from -9.2 percent employment between 2005-2010 to 5.0% between 2010 and 2015. That’s significant.

- This Size and Impact Report, issued on the heels of the association’s Global Business Trends Report, also includes state-level data and insights. Did you know that Texas has the highest employment in the plastics industry? California comes second, followed by (in order) Ohio, Michigan, Illinois, Indiana, Pennsylvania, Wisconsin, North Carolina and New York – together they make up the Top 10.

Sections within the report begin with an overview of the industry and go on to compare our industry with others; provide data on the rates of growth of the many sectors, including moldmaking, that fall under the plastics industry heading; offer geographic-based metrics on where in the U.S. the plastics industry is strongest (and weakest); as well as give insights and data supporting upstream (supplier) impacts and downstream (user) impacts. Even if you just read the Key Insights and Commentary on pages 7 and 8 you will have gained a valuable understanding of where this industry is headed, and that can have an impact on how you manage and invest in your future.

PLASTICS President and CEO William R. Carteaux says, “On the heels of the arrival of a new Congress and, soon, a new Administration, the Size & Impact Report shows why the plastics industry will be such an important part of the effort to support job growth in manufacturing. The U.S. plastics industry continues to meet the needs of the global market, and then some; every day seems to bring news of a new, innovative application for plastic materials that makes the world a stronger, more sustainable place. The plastics industry is ready to work together with Congress, the Administration and its partners to lead American manufacturing into a new golden era.”

This is an information-packed report worthy of review. Download a copy of the U.S. Size & Impact report here.

Related Content

Creative Blow Mold Tooling Acquires ISBM Business from Big 3 Precision Mold

Illinois-based Creative acquires Big 3's injection stretch blow mold division, expanding capabilities while retaining workforce and intellectual property.

Read MoreEconomic Shifts in 2025: Will Construction and Auto Sectors Drive Plastics Growth?

With lower interest rates expected in 2025, construction and auto sectors could drive plastics demand, revitalizing moldmaking and manufacturing investment.

Read MoreHow Industrial Molds Conquered a Complex Impeller Fan Mold Challenge

Expert engineering team overcomes complex impeller fan mold challenges through innovation, precision and collaborative problem-solving.

Read MoreMinimizing Secondary Operations in Injection Molding

A compact solution for high-quality parts with direct injection, eliminating halos.

Read MoreRead Next

How to Use Strategic Planning Tools, Data to Manage the Human Side of Business

Q&A with Marion Wells, MMT EAB member and founder of Human Asset Management.

Read MoreYour Guide to Smarter, Faster Mold Design

Dive into expert-curated content delivering proven solutions for mold optimization, manufacturability and precision performance.

Read MoreOvercoming Pain Points in Moldmaking with AI

Shops that embrace AI as a tool, not a threat, can enhance efficiency, preserve expertise, and attract tech-savvy talent.

Read More